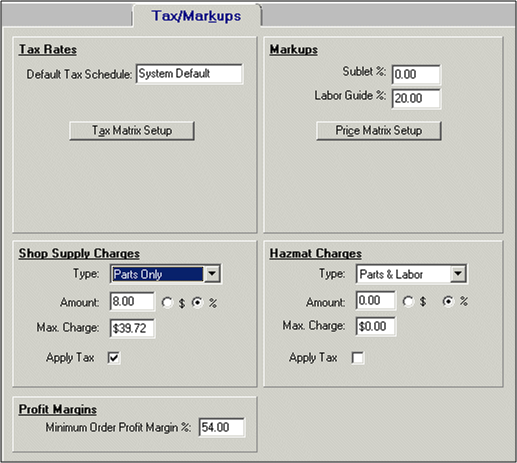

Tax/Markups Tab (Price Matrix Setup)

To access taxes and markups:

-

From the Setup shortcut bar, select Company Setup.

-

Select the Tax/Markups tab.

-

Tax Rates

-

The Default Tax Schedule field shows the name of the schedule currently set as the default.

-

Use the Tax Matrix Setup button to open the Tax Rate & Schedule window, where you can:

-

Configure the tax rates and tax schedules.

-

Select which schedule to use as a default Tax Schedule.

-

-

-

Markups

-

Enter:

-

Sublet %: Enter the markup percentage for work you send to other shops.

-

Labor Guide %: Enter the markup percentage for labor items from the ALLDATA® Parts and Labor Guide.

-

-

Click Price Matrix Setup to open the Price Matrix Setup window, where you can configure the markup and profit margin rates.

-

-

Shop Supply Charges

-

Hazmat Charges

-

Profit Margins

-

Enter your shop’s Minimum Order Profit Margin percentage.

-

-

Click Submit.

Note: If you edit tax or markup information that appears on any estimates or repair orders, the tax and markup information on the estimate or repair order is updated.

- Editing tax or markup information does NOT affect cashiered orders, posted invoices or service history.