Why should you care about statistics and business trends? Because you don’t want surprises! When trends indicate the economy may be slowing, you want to take steps to ensure your customers will keep coming back. Or, trends may alert you that it’s time to think about hiring another technician or to upgrade shop equipment. Well-informed shop owners who fully understand the industry are better equipped to handle economic swings, stay connected with customers and prepare for change.

By permission, we are presenting some interesting aftermarket industry statistics on vehicle maintenance and repair services from an award-winning annual report released in May 2014 and written by the Auto Care Association, formerly AAIA (Automotive Aftermarket Industry Association). Within

The 2015 Digital Auto Care Factbook, we found some great news for the automotive aftermarket. Check out some of the positive trends identified in the report:

- Growth! The U.S. Motor Vehicle Aftermarket, a $307.7 billion industry in 2012, is expected to exceed $360 billion in 2017 – a 3.4% growth. The number of vehicles in operation is growing by 5% annually, expecting to hit 260 million by 2018!

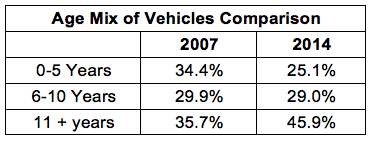

- Average Vehicle Age is Climbing! Industry growth is being fueled by an increase in the average age of vehicles, 11 years old and up. Motorists are taking advantage of the fact that cars are engineered to last longer and this will mean more vehicle maintenance.

- Industry Confidence. A highly respected “confidence index”* for February stood at 33.8, up dramatically from 8.33 in February 2013. Aftermarket leaders are clearly confident in the industry – a good barometer of the economy as a whole.

- Industry Employment. A total of 4.20 million people worked in the auto care industry in 2013, continuing the upward employment trend begun in 2011. This includes a 2.8 percent increase in total employment during 2011-2012 – 115,500 jobs in just a year!

In 2013, more than 812,000 technicians were employed at repair shops, dealerships and gas stations. The demand for technicians has surged ahead of supply.

Additional Industry Trends

ALLDATA supports the automotive repair and collision industries with proven systems and services that make a positive difference. Here’s what we see as five major industry trends for shops and technicians:

- Shop Marketing Matters

Shops are budgeting for marketing. Social media, email and web marketing has made it easy and inexpensive to attract and retain customers. - Smartphones Rule with Consumers

43% of drivers perform a search online or on their smartphones when deciding where to take their vehicle for service in 2013**. You can no longer ignore those “constantly connected consumers.” Repair shops definitely need a web site – one that is optimized for computers, tablets and smartphones. - Tablets Rule for Technician Efficiency

Having to walk away from the car to check repair data on a laptop or PC is inefficient. Tablet technology powered by ALLDATA® MobileSM now allows a technician to carry procedures and diagrams with him/her at the car and even under it. Contact us today for a free trial. Click here to see a live demo. - Continuing Education is Critical

The industry is demanding smarter technicians. Now more than ever, shops must provide employee training ( ALLDATA Training GarageSM, for example). Shops that provide training will be sought-after for two reasons:

- Efficiency! Technicians will know about productivity tools, such as the ALLDATA Research Library and the ALLDATA Community Diagnostics Team. Quickly finding critical repair information will reduce repair times and boost revenue.

- Customer retention! Customers will frequent shops they view as efficient, up-to-date and technologically savvy

- OEM Dealerships Are Price Competitive

As dealerships cut costs, independent shops will have to operate smarter.

The aftermarket has an opportunity to thrive by understanding positive industry trends. Change is inevitable and it encourages innovation. That’s a good thing! Over the years, ALLDATA has learned a thing or two about what it takes to help a shop succeed, and we’re here for you with a wide range of total shop solutions.

* The Auto Care Association/Northwood University Automotive Aftermarket Business Confidence Index is an economic indicator that measures the amount of optimism or pessimism that business managers feel about the prospects of their companies/organizations.

Want to see how ALLDATA can improve shop efficiency? Check out our suite of products, each designed to contribute to both shop efficiency and productivity.

If you would like to read more articles like this one please subscribe to ALLDATA News.