Who Pays for What? survey by

Collision Advice | CRASH Network

You know how much hard work it takes to get customers’ vehicles back on the road safely. When it comes to maximizing your return, it pays to know how often other shops across the country are being reimbursed by the insurers for the same procedures.

Luckily, the results of the latest Who Pays for What? survey do just that, providing a goldmine of valuable information that could directly improve your bottom line.

Two new procedures were added to this year’s Calibration & Scanning survey: vehicle safety inspections and in-process scans, those done after the pre-repair scan, but before the final scan of the vehicle prior to delivery.

The updated results also validate ALLDATA’s ranking as the #1 choice among body shops for researching OEM repair information and procedures. 74% use ALLDATA as their OEM resource, a slight uptick from 2021.

About the survey

Mike Anderson

Collision Advice

Who Pays for What? is a series of surveys launched in 2015 by Mike Anderson’s Collision Advice and CRASH Network to help repair facilities better understand how their billing practices differ from others in the industry.

The latest survey, Who Pays for What? Scanning & Calibration, ran in October 2022. It asked body shops nationwide to report how often they are paid for a variety of shop repair procedures and shop supplies by the eight largest auto insurers.

The report reveals how often insurers pay shops for dozens of collision-specific procedures and materials, from scanning and OEM research to boron drill bits and seam-sealers.

In the introduction, Anderson advises shop estimators and staff to review these results to identify procedures they may want to include on estimates and invoices when appropriate, if they’re not currently compensated for those.

It’s well worth reading the entire 74-page document, but to get you started, here are some key callouts on scanning trends and OEM repair information research, including the two new procedures.

New for 2022 – Vehicle safety inspections

Procedure: Conduct procedures required by some automakers after a vehicle has been in a collision, such as measuring the steering column, inspecting the dash carrier, inspecting SRS sensors, etc.”

Of those that negotiate for this, 38% are paid “always” or “most of the time.”

| Always | Most of the Time | Some of the Time | Never | Never Asked | Responses | |

| Allstate | 16.4% | 16.8% | 35.4% | 31.4% | 40% | 457 |

| Farmers | 20.2% | 17.8% | 37.2% | 24.8% | 40.3% | 432 |

| Geico | 21.6% | 17.3% | 32.2% | 29% | 38.5% | 460 |

| Liberty Mutual | 19.6% | 18.5% | 37.7% | 24.2% | 39.6% | 439 |

| Nationwide | 20.9% | 17.3% | 37.4% | 24.4% | 40.5% | 427 |

| Progressive | 22.9% | 18.7% | 31.3% | 27.1% | 39.7% | 471 |

| State Farm | 20.9% | 13.9% | 35.5% | 29.6% | 38.9% | 470 |

| USAA | 23.5% | 17.6% | 36% | 22.8% | 39.7% | 451 |

Anderson reminds shop owners that “…a third-party payer refusing to pay you DOES NOT remove you from any liability based on a failure to conduct these safety inspections.”

A first: more than 90% of shops are doing pre- and post-scans

2022 marks the first year that more than 90% of shops report conducting a pre- and post-repair scan on all or most vehicles.

91% of shops pre-scan all or most vehicles, up from 78% in 2019.

| Pre-Repair Scan | 2022 | 2021 | 2020 | 2019 |

| All | 59% | 51.7% | 37.5% | 36.8% |

| Most | 31.6% | 33.5% | 41.1% | 40.8% |

| More than half | 4% | 4.6% | 7.7% | 6.4% |

| Half | 2% | 3.5% | 4.5% | 4.9% |

| Less than half | 1.2% | 3.7% | 3.4% | 4.9% |

| A few | 2% | 2.7% | 4.9% | 5.1% |

| None | .2% | .4% | .9% | 1.2% |

94% conduct a post repair scan on all or most vehicles, up from 88% in 2019.

| Post-Repair Scan | 2022 | 2021 | 2020 | 2019 |

| All | 64.2% | 58.3% | 47.2% | 41.7% |

| Most | 29.7% | 34.6% | 43.2% | 46.1% |

| More than half | 2.6% | 2.7% | 4.6% | 3.9% |

| Half | 1.2% | 2.7% | 2.5% | 4.1% |

| Less than half | .8% | 1.1% | 1% | 2.9% |

| A few | .8% | .4% | 1.1% | 1.1% |

| None | .6% | .2% | .6% | .3% |

Anderson notes, “With many shops conducting scans throughout the repair process, I expect to see the number reporting in-process scans of all or most vehicles to rise sharply in the coming years.”

Pre-repair scan

Procedure: Connect a scan tool to the vehicle prior to disassembly to view, document and diagnose diagnostic trouble codes (DTCs) and live data, and to verify horizontal and vertical values of ADAS components and steering angle sensors.

Of those that negotiate for this, 88% are paid "always", or "most of the time," up from 84.1% in 2021

Anderson is passionate about the necessity of performing a pre-scan, noting, “It is amazing and concerning to me that as we are working on newer and newer vehicles that this is not done and paid for 100% of the time. Collision repairers need to wake up to the fact that this is needed, and that it is impossible to write an accurate estimate or repair plan without doing so - to diagnose what a vehicle needs such as seat belts or other required parts and labor.”

In-process scan - New for 2022

Procedure: Connect a scan tool to the vehicle post-repair to view and diagnose diagnostic trouble codes (DTCs) and live data, and to verify values of ADAS components and steering angle sensors.

Of those that negotiate for this, 36% are paid “always” or “most of the time.”

Anderson calls this “… an absolutely necessary process, and just as important as a pre- and post-repair scan.”

Post-repair scan

Procedure: Connect a scan tool to the vehicle post-repair to view and diagnose diagnostic trouble codes (DTCs) and live data, and to verify values of ADAS components and steering angle sensors.

Of those that negotiate for this, 91% are paid "always" or "most of the time," up from 88.7% in 2021

| DRP | Always | Most of the Time | Some of the Time | Never | Never Asked | Responses |

| Allstate | 78.8% | 18.2% | 3% | 0% | 1.5% | 67 |

| Farmers | 82.5% | 12.5% | 3.8% | 1.3% | 1.2% | 81 |

| Geico | 71.9% | 18.8% | 6.3% | 3.1% | 0% | 32 |

| Liberty Mutual | 78.3% | 19.6% | 2.2% | 0% | 2.1% | 47 |

| Nationwide | 88% | 9.6% | 2.4% | 0% | 1.2% | 84 |

| Progressive | 83.1% | 13.6% | 3.4% | 0% | 0% | 59 |

| State Farm | 87.5% | 10.5% | 1.3% | .7% | 0% | 152 |

| USAA | 83.1% | 13.6% | 3.4% | 0% | 0% | 59 |

| Non-DRP | Always | Most of the Time | Some of the Time | Never | Never Asked | Responses |

| Allstate | 64.3% | 22.3% | 10.9% | 2.5% | 1.3% | 372 |

| Farmers | 70.8% | 22.5% | 6.2% | .6% | 1.5% | 330 |

| Geico | 68.8% | 23.1% | 6.1% | 2% | 1% | 411 |

| Liberty Mutual | 69.8% | 22.3% | 5.8% | .9% | 1.8% | 331 |

| Nationwide | 71.1% | 22.2% | 5.8% | .9% | 1.8% | 331 |

| Progressive | 72.2% | 20.8% | 6.2% | .8% | 1% | 393 |

| State Farm | 51.2% | 27.1% | 14.7% | 7% | 1.3% | 303 |

| USAA | 73.2% | 21.1% | 4.6% | 1.1% | 1.3% | 374 |

Anderson adds, “It’s interesting to note that there are very few shops NOT seeking to be paid for post-repair scanning. This is different from some of the other procedures where a significant percentage of shops aren’t getting paid because they’re not seeking to be paid. In this case, when shops aren’t being paid, it’s generally because of friction from the insurance carriers. But also remember that an insurer refusing to pay for a post-repair scan does not remove your shop’s liability for not conducting a scan.”

Use of OEM repair information continues to climb

In 2022, 60% of respondents say they research OEM repair procedures “All or most of the time,” compared to 43% in 2015, according to the report. This trend reflects the industry’s focus on the necessity of following OEM procedures for safe and accurate vehicle repair – and to limit liability – as vehicles become increasingly complex.

How frequently do you research OEM repair procedures at the time you write an estimate?

| Pre-Repair Scan | 2022 | 2021 | 2020 | 2019 | 2018 |

| All the time | 23.7% | 21.2% | 19.9% | 21.5% | 24.8% |

| Most of the time | 35.2% | 36.5% | 32.6% | 32.7% | 35.7% |

| Some of the time | 23.1% | 26.5% | 27.4% | 26.5% | 24.8% |

| Only occasionally | 15.2% | 13% | 15.4% | 14.7% | 12.7% |

| Never | 2.9% | 2.8% | 4.7% | 4.6% | 2% |

According to one of Anderson’s “Fun Facts,” it takes the average person 5-6 minutes to read a one-page technical document? That doesn’t include the research time to find it, nor the similar amount of reading time a technician will need to spend reviewing it.

74% of body shops use ALLDATA for OEM repair information

Since the Who Pays For What? survey launched in 2015, ALLDATA has been the top choice of auto body shops for online OEM repair information.

For 2022, 74% of respondents say they use ALLDATA compared to 51% that use Automaker information websites, 44% that use I-CAR, 43% that use CCC, and 12% that use Mitchell.

Which of the following systems do you use to research OEM repair information?

| OEM Information Sources | 2022 | 2021 | 2020 | 2019 | 2018 |

| ALLDATA | 73.9% | 73.4% | 72.4% | 62.8% | 72.4% |

| Automaker information webites | 51.1% | 52.8% | 51.5% | 59.4% | 52.6% |

| I-CAR’s “Repairability Technical Support” | 43.5% | 46.4% | 49.8% | 55.4% | 54.2% |

| CCC’s “Repair Methods” | 43.1% | 43.4% | 44.3% | 49.2% | 45.8% |

| Mitchell’s “Tech Advisor” | 12.2% | 13% | 15.7% | 14.4% | 12.5% |

| OEConnection's "RepairLogic" | 7.3% | ||||

| Sun | 3.7% | 3.2% | 1.7% | ||

| Auda Explore’s “TechFocus” | .6% | .9% | .5% | 1.6% | 3% |

OEM repair information research – billing for labor time

Procedure: Labor time required for OEM repair information research.

Of those that negotiate for this, 14% are paid "always" or "most of the time," down from 19.7% in 2015

Anderson notes, “I’m seeing the typical amount of total sales a single estimator can handle decline, because the estimating process continues to become more complex, including research of OEM repair information. I’m starting to see a few shops with an employee doing nothing but scanning vehicles and researching OEM repair procedures. I think it will be interesting to watch this moving forward.”

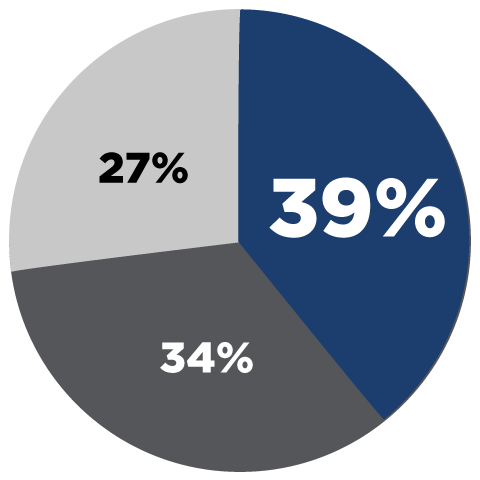

OEM repair information – billing for your subscription

Whether or not this location bills for the time to research OEM repair information, do you add a separate line-item charge to cover subscription fees for OEM repair information?

39% have never passed along a charge for OEM subscription fees

34% charge only when using websites for which they don’t have an annual subscription

27% always (or almost always) include a subscription fee charge

Anderson says what’s important is that the percentage of shops saying they have never charged for subscription fees has dropped to 39% this year from 42% in 2021, 51% in 2020, and 57% in 2019. In other words, more shops are including fees for subscriptions to help recoup costs.

To access Who Pays for What? survey results or to become a survey participant, visit www.crashnetwork.com/collisionadvice.

Did you know that ALLDATA’s award-winning ADAS Quick Reference tool gives you immediate access to ADAS components and procedures? It’s included at no additional cost with ALLDATA Collision, the industry’s #1 choice for unedited OEM repair information and integrated shop productivity solutions.

|

For past Who Pays for What? survey results or to become a survey participant, visit www.crashnetwork.com/collisionadvice. |

Ready to see for yourself why the majority of auto body shops (74%) use ALLDATA’s industry-leading OEM repair information? Check out ALLDATA Collision and our integrated technology platform of shop productivity tools.

If you would like to read more articles like this one please subscribe to ALLDATA News.