Who Pays for What? survey by

Collision Advice | CRASH Network

Last month, we reported on results from the Who Pays for What? survey by Collision Advice and CRASH Network that showed the use of OEM information on the rise and ALLDATA’s continued dominance (73.4%) as the #1 choice for that essential repair information. Now let’s see what collision shop owners and techs had to say pre- and post-repair vehicle “health scans” and DTC research.

About the survey

Mike Anderson

Collision Advice

Who Pays for What? is a series of surveys launched in 2015 by Mike Anderson’s Collision Advice and CRASH Network to help repair facilities better understand how their billing practices differ from other repair facilities, including whether other shops are being paid for procedures their shop may be doing, but for which they are not being compensated.

The Who Pays for What? Scanning & Calibration survey ran from October 1-31, 2021, and asked body shops nationwide to report how often they are paid for a variety of shop repair procedures and shop supplies by the eight largest auto insurers.

85% of shops said they pre-scan "all" or "most" vehicles (up from 79% in 2020) and 93% conduct a post-repair scan on "all" or "most" vehicles (up from 88% in 2020).

The online survey was open to all auto body repair facilities, and was promoted through the trade press as well as direct invitations to more than 20,000 individuals in the industry. The survey received responses from 605 collision repair professionals, 83% of which were owners or managers. The respondents represented shops from 48 states. In addition, respondents were asked to provide their DRP status with each insurer in the survey. The other surveys in the series examine procedures related to mechanical repair, body repair operations, and refinish-related procedures.

Vehicle scanning on the rise

When asked, “Of all the vehicles that come in to this location, approximately how many receive a PRE-repair vehicle scan and a POST-repair vehicle scan?”

85% of shops said they pre-scan "all" or "most" vehicles (up from 79% in 2020) and 93% conduct a post-repair scan on "all" or "most" vehicles (up from 88% in 2020).

For both pre- and post-scans, the survey defines the procedure as follows: “Connect a scan tool to the vehicle to view and diagnose diagnostic trouble codes (DTCs) and live data, and to verify values of ADAS components and steering angle sensors.”

| Pre-repair scan | 2021 | 2020 | 2019 |

| All | 51.7% | 37.5% | 36.8% |

| More than half | 4.6% | 7.7% | 6.4% |

| Half | 3.5% | 4.5% | 4.9% |

| Less than half | 3.7% | 3.4% | 4.9% |

| A few | 2.7% | 4.9% | 5.1% |

| None | .4% | .9% | 1.2% |

| Post-repair scan | 2021 | 2020 | 2019 |

| All | 58.3% | 47.2% | 41.7% |

| More than half | 34.6% | 43.2% | 46.1% |

| Half | 2.7% | 4.6% | 3.9% |

| Less than half | 1.1% | 1% | 2.9% |

| A few | .4% | 1.1% | 1.1% |

| None | .2% | .6% | .3% |

“It appears we’re trending in the right direction but still not fast enough,” Anderson notes. “Information related to this in the vehicle owner’s manual can be a good educational tool.”

84% of shops are getting paid for pre-repair health scans; 88% for post-repair scans

Of shops that negotiate to get paid for a pre-repair vehicle health scan, 84% are paid "always" or "most of the time" a 15% increase since 2019, according to insurers.

| Always | Most of the Time | Some of the Time | Never | Never Asked | Responses | |

| Allstate | 58.8% | 24.6% | 14.1% | 2.5% | .6% | 520 |

| Farmers | 59.7% | 25.3% | 13.9% | 1.1% | .8% | 478 |

| Geico | 55.8% | 24.2% | 17.4% | 2.5% | .4% | 518 |

| Liberty Mutual | 60.6% | 24.4% | 13.3% | 1.6% | .8% | 499 |

| Nationwide | 64.5% | 22.9% | 11.1% | 1.5% | 1% | 481 |

| Progressive | 65.8% | 22.6% | 9.3% | 2.3% | .4% | 529 |

| State Farm | 49.1% | 22.8% | 20.3% | 7.8% | .4% | 538 |

| USAA | 66.2% | 22.9% | 10.1% | .8% | 1% | 511 |

(totals more than 100% because multiple selections were allowed)

For post-repair vehicle health scans, 88% of shops are paid "always" or "most of the time."

Anderson adds this warning, “Some vehicles need to be driven a certain distance or have a set number of key cycles before a dash light is triggered. So the post-repair scan has to be done to ensure all the safety and comfort features of the vehicle are working properly. There is no dash warning light, for example, that tells you the Bluetooth feature isn’t working. There may be no dash light for blind-spot monitoring or adaptive cruise control. So, I look forward to the day when post-repair scans are being paid 100 percent … But also remember that an insurer refusing to pay for a post-repair scan does not remove your shop’s liability for not conducting a scan.”

Scanning methods

The survey also asked shops to “Select all the methods you currently use to scan vehicles.” The majority use aftermarket scanning equipment in-house (68%), followed by a remote scanning service (56%).

| Vehicle scanning is done with: | 2021 | 2020 | 2018 | 2017 | 2016 |

| Aftermarket scanning equipment (Matco, Snap-On etc.) in-house | 68.1% | 67% | 62% | 61% | 69% |

| Remote scanning service (asTech, AirPro diagnostics, etc.) | 56% | 53% | 42% | 33% | 22% |

| Transport the vehicles to dealerships or other vendors for scanning | 37% | 40% | 25% | 37% | 48% |

| OEM scan tools in-house | 31% | 28% | 17% | 13% | 14% |

| Mobile scanning service that comes to shop location | 25% | 23% | 18% | 15% | 18% |

| Never do vehicle scans | 0% | <1% | <1% | 1% | .1% |

What do shops charge for in-house scans?

In 2021, shops most commonly bill up to one hour of mechanical labor to perform an in-house scan. Only 4% charge more than one hour of time. Overall, two-thirds of shops (66%) said that any diagnostic time, such as researching trouble codes, is included in their scan charge.

| In-house scanning charges | 2021 | 2020 | 2018 |

| Up to 1 hour of mechanical labor | 54% | 55% | 50% |

| Up to 1 hour of body labor | 18% | 13% | 11% |

| Flat fee | 17% | 17% | 25% |

| 1 or more hours of mechanical labor | 4% | 8% | 10% |

| No set rate, varies by vehicle | 3% | 4% | 5% |

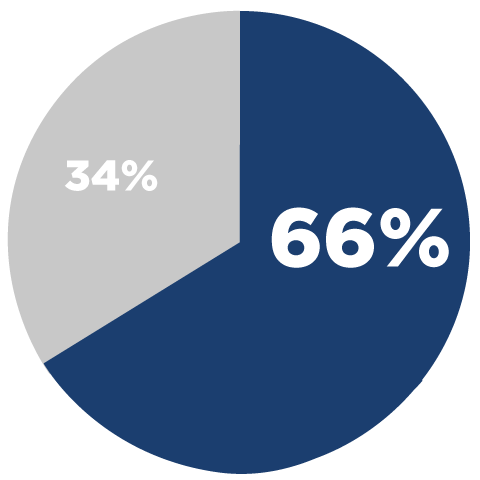

66% of shops include diagnostic time with scanning

When asked, “Do you include your diagnostic time in with your scanning charge, or do you itemize for diagnostic time (such as researching DTCs) separately from the scanning charge?” two-thirds of shops (66%) say their scanning charge includes any diagnostic research time. This is up from 61% in 2020. Meaning only 34% of shops are separately itemizing diagnostic time from the scanning charge.

Diagnostic time included with scanning charge (66%)

Diagnostic time itemized separately from scanning charge (34%)

Anderson doesn’t approve, commenting, “I have a hard time understanding this survey finding because I know first-hand how much time it takes to research and troubleshoot DTCs. I think this is an indication of a lack of education.”

Why aren’t shops doing pre- or post-repair scans?

Shops overwhelmingly (77%) cited the age of the vehicle as their primary reason for not conducting pre- or post-vehicle scans when responding to the question, “When you have NOT performed a pre- or post-repair scan, which factors most lead to this decision?”

| Reasons for not scanning vehicle PRE-repair | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

| Age of the vehicle | 77% | 75% | 78% | - | - | - |

| The level of damage doesn’t warrant a pre-repair scan | 50% | 43% | 44% | 52% | 53% | 51% |

| The vehicle doesn’t have any high-tech systems to be concerned about | 29% | 26% | 29% | 39% | 35% | 28% |

| We don’t get paid for vehicle pre-repair scans by the insurer | 19% | 14% | 14% | 20% | 29% | 37% |

| No cause for a pre-repair scan because no dash lights are lit | 15% | 8% | 11% | 13% | 13% | 34% |

| We don’t have enough staffing, training, scan tool or other equipment | 3% | 4% | 2% | 8% | 16% | 21% |

| Cycle time concerns - pre-repair scanning process takes too long | 2% | 2% | 1% | 2% | 3% | 4% |

| We never considered performing a pre-repair scan | 0% | 1% | 1% | 4% | 4% | 15% |

Anderson harshly responded to those not taking the need to conduct pre- and post-scans seriously, saying, “I continue to be at a loss for words as to how some shops believe the ‘age of the vehicle’ would allow them to skip scanning that vehicle. I have documentation from as far back as the year 2000 stating that scans are needed.”

Getting paid to “Research diagnostic trouble codes”

This procedure is described as, “Time to research codes per OEM repair procedures and navigate flow-charts to trouble-shoot the vehicle.”

Of those that negotiate for this, 24% are paid "always" or "most of the time."

| Overall | Always | Most of the Time | Some of the Time | Never | Never Asked | Responses |

| Allstate | 13.2% | 10.5% | 29.8% | 46.5% | 49% | 447 |

| Farmers | 13.3% | 10% | 33.6% | 43.1% | 50.2% | 424 |

| Geico | 13.6% | 9.6% | 30.3% | 46.5% | 49% | 447 |

| Liberty Mutual | 14.8% | 11.1% | 29.6% | 44.4% | 49.3% | 426 |

| Nationwide | 14.8% | 10.6% | 30.1% | 44.4% | 48.9% | 423 |

| Progressive | 14.8% | 11.3% | 30.9% | 43% | 49% | 451 |

| State Farm | 12.3% | 8.6% | 28% | 51% | 47.4% | 462 |

| USAA | 15.1% | 11.4% | 31.1% | 42.5% | 50.1% | 439 |

Research diagnostic trouble codes - 2021

“This was a new procedure we added to the survey in 2020,” Anderson notes in the report. “I had really expected the percentage of shops billing and being paid regularly for this to grow in 2021. Note how many shops indicated they have never sought to be paid for this process. It is my position that diagnostic time should be separated from the scan labor operation because there are many variables involved. It’s similar to how repair times will vary based on the substrate involved and the size and location of the damage. Diagnostic time will also vary based on the number of diagnostic trouble codes (DTCs) the vehicle has, and how easily they can be identified and researched in the OEM procedures.”

How shops use the survey results

According to the survey report, 88% of shops say they’ve been able to use “Who Pays For What?” surveys to help grow their business. Specifically, 75% said they leverage the information to train/remind staff about "not-included" repair procedures, 71% as a regular reminder of the "not-included" procedures they are doing (but should be charging for), and 47% share survey results with insurance company reps to demonstrate that they are not "the only one."

“That’s the whole reason we do these surveys and ask you to participate: because we believe doing so will have a positive impact on your business,” Anderson said. “Now, nearly 9 out of 10 of you say that’s the case.”

|

For past Who Pays for What? survey results or to become a survey participant, visit www.crashnetwork.com/collisionadvice. |

Want to see how ALLDATA can improve shop efficiency? Check out our suite of products, each designed to contribute to both shop efficiency and productivity.

If you would like to read more articles like this one please subscribe to ALLDATA News.